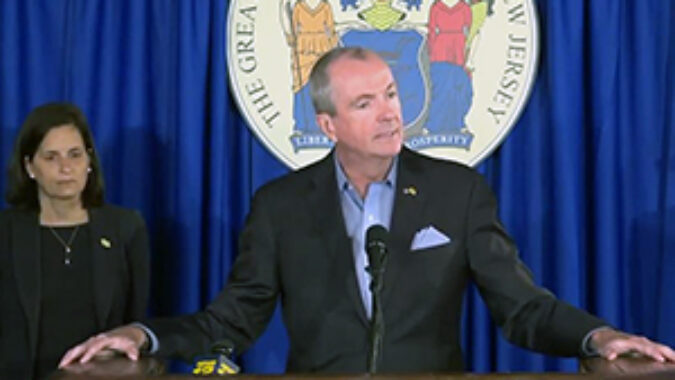

Gov. Phil Murphy and State Treasurer Elizabeth Muoio held a news conference Friday to discuss the state budget passed by the Legislature.

Gov. Phil Murphy on Friday said he would meet his constitutional responsibility to sign the FY 2020 state budget by July 1, though the final document may not be exactly the same $38.8 billion spending plan the Legislature delivered to him yesterday afternoon.

Murphy has three options: Sign the budget into law as it is now, veto it outright, or use his line-item veto power to cut specific spending items. He cannot, however, add tax increases or new spending for any programs he sought that the Legislature did not include in the budget document.

“All options are on the table and we will use the whole clock,” Murphy said in a reference to the July 1 constitutional deadline.

“In whatever form the budget I ultimately sign takes… there is no question that when it comes to the middle-class investments and the agenda that I have set forth, the Legislature has overwhelmingly concurred,” Murphy said.

The governor took issue, however, with the Legislature’s decision to reject the millionaires tax he had sought, which would have required households, as well as small businesses that flow income through the owners’ personal returns, to pay a 10.75% tax rate on income over $1 million.

“We need to be serious about saving for tomorrow and putting our excess revenues into our empty Rainy Day Fund,” Murphy said. “We cannot continue to budget as though the only thing that matters is getting us through the new few days. It’s time we look to the upcoming decade.”

State Treasurer Elizabeth Muoio said that with economic experts predicting that a national recession is ahead, the clock is ticking on New Jersey’s ability to build up its economic reserves through revenue raisers such as the millionaires tax. She noted that during the last recession states received significant help from the federal government and “we have no idea if we’ll be able to depend on that again.”

“The bottom line is that we need to rebuild our Rainy Day Fund and we need recurring revenue sources,” Muoio said. “I stand here with the governor today in complete agreement that we need to put an end to short-sighted politically expedient budget fixes,” Muoio said.

Murphy said his fight for “tax fairness” would continue after the budget deadline passed.

“Tax equity, tax fairness, this notion of presenting a long-term funding plan doesn’t die on June 30,” Murphy said.

Murphy and Muoio were joined at the news conference by the past and current presidents of the left-leaning think tank, NJ Policy Perspective, who called not only for the millionaires tax but also for raising the state sales tax back to 7 percent and reinstating the estate tax that was eliminated in 2018.

NJBIA has strongly opposed efforts to raise taxes on New Jersey residents and businesses, arguing that structural budget reforms are needed to address the state’s unfunded liabilities and reduce state spending.